More Economic Strength Sent Stocks Lower All Week

Published Friday, October 20, 2023 at: 8:27 PM EDT

Retail sales, housing starts, and initial unemployment claims all came in stronger than expected this past week, indicating the U.S. economic expansion is strengthening, which sent bond yields higher and stock prices lower.

Key U.S. economic data for the week ended October 20, 2023:

- Census Bureau’s retail sales figures for September reported on Tuesday, Oct 17, came in 0.7% higher than in August -- more than twice the 0.3% growth expected by Wall Street. American consumers, who account for 70% of U.S. growth, are continuing to spend on cars, dining out, and entertainment despite higher lending rates on debt.

- Housing starts, reported the next day by the Census Bureau, came in at 1.36 million, a tick lower than the 1.37 million expected. With a 30-year mortgage rate now topping 8% for the first time in over two decades, while the single-family home construction is not roaring but is also not falling apart.

- Initial jobless claims for the week ended October 14 came in at 198,000, less than the 210,000 expected, indicating the tight labor market is not weakening.

The stronger than expected data come after the U.S. Federal Reserve Bank raised rates 11 times in the past 18 months, by more than 1000%, in a campaign to snuff the worst inflation cycle since the early 1980s. This added to uncertainty over whether the Federal Reserve will raise rates yet again at its next meeting, on November 7th, hinting rates will not be hiked for a 12th time since March 2022 at the next meeting of U.S. central bankers. Federal Reserve Chairman Jerome Powell, in a speech at the Economic Club of New York on Thursday, Oct. 19, said, “Doing too much could also do unnecessary harm to the economy.”

Despite the Fed chief indicating no rate increase is likely at the next meeting, the strength of the economic data this past week caused stock prices to weaken. The stock market is usually an indicator of what will happen in three or four months, and investors appear to be concluding the strength of the economy could warrant another rate increase by the Fed or policymakers may decide to maintain high rates for longer to ensure inflation is no longer a serious threat.

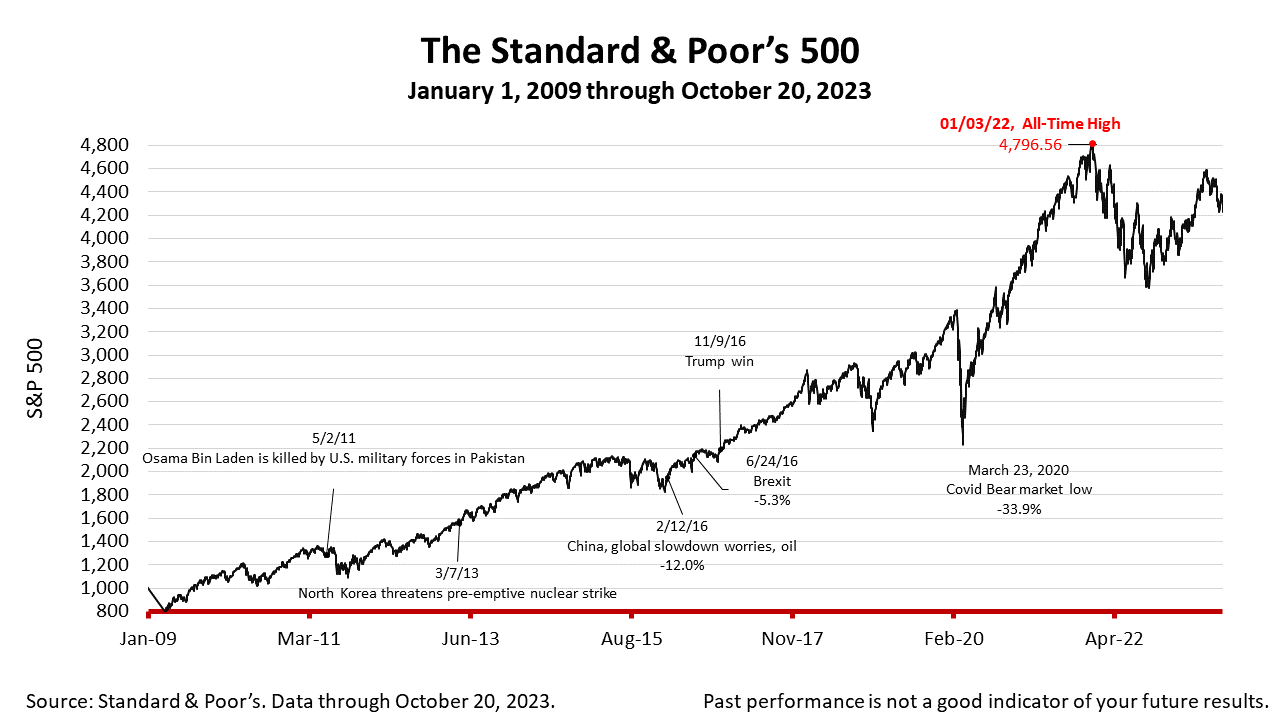

The Standard & Poor’s 500 stock index closed Friday at 4224.16, down -1.26% from Thursday, and down -2.39% from a week ago. The index is up +88.80% from the March 23, 2020 bear market low and down -11.93% from its January 3, 2022, all-time high

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding